2025 Ca State Withholding Form. Calculate your tax using our calculator or look it up in a table of rates. Paylocity updated standard deduction and allowance values for the effective date of january 1, 2025.

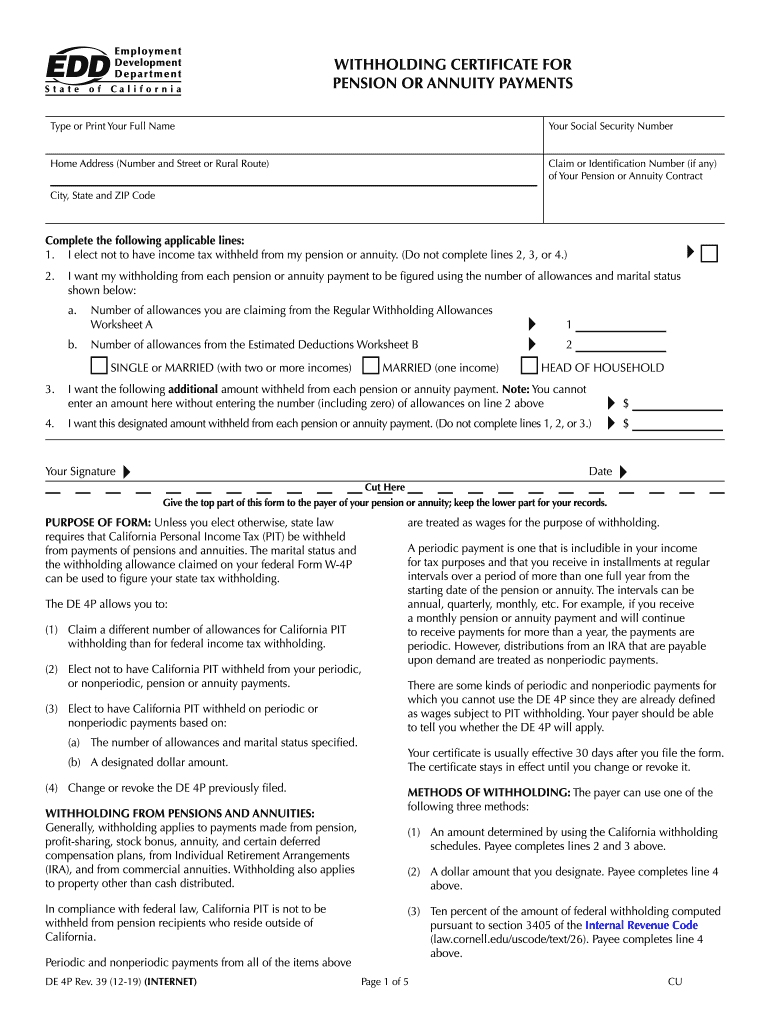

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. To download this form, log in using the orange sign.

California State Withholding Form 2025, The paycheck calculator below allows. Effective january 1, 2025, senate bill (sb) 951 removes the taxable wage limit and maximum withholdings for each employee subject to state disability insurance (sdi).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Effective january 1, 2025, senate bill (sb) 951 removes the taxable wage limit and maximum withholdings for each employee subject to state disability insurance (sdi). California’s withholding methods will be adjusted for 2025.

Employee Pa State Withholding Form 2025 Employeeform Net Vrogue, Enter personal information (a) first name and middle. To 10:00 p.m., pacific time, due to scheduled maintenance.

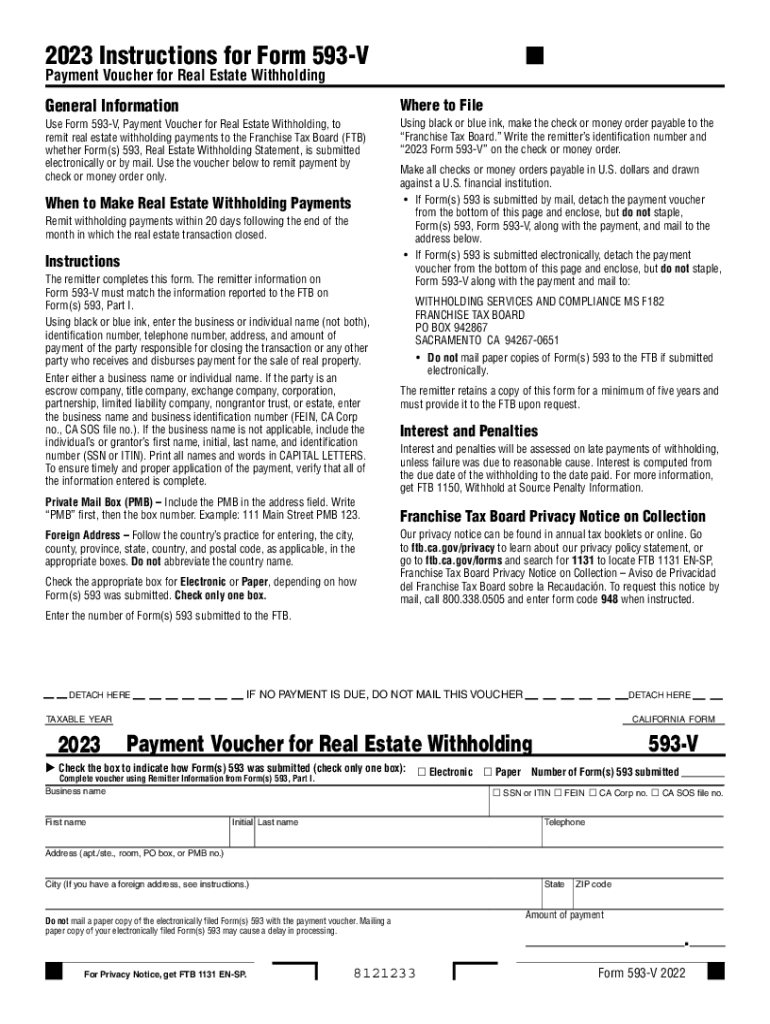

Employee Pa State Withholding Form 2025 Employeeform Net Vrogue, Application for tentative refund of withholding on 2025 sales of real property by nonresidents. Calculate your tax using our calculator or look it up in a table of rates.

w4formemployeeswithholdingcertificate pdfFiller Blog, Credit card services may experience short delays in service on wednesday, may 1, from 7:00 p.m. The california state tax calculator (cas tax calculator) uses the latest federal tax tables and state tax tables.

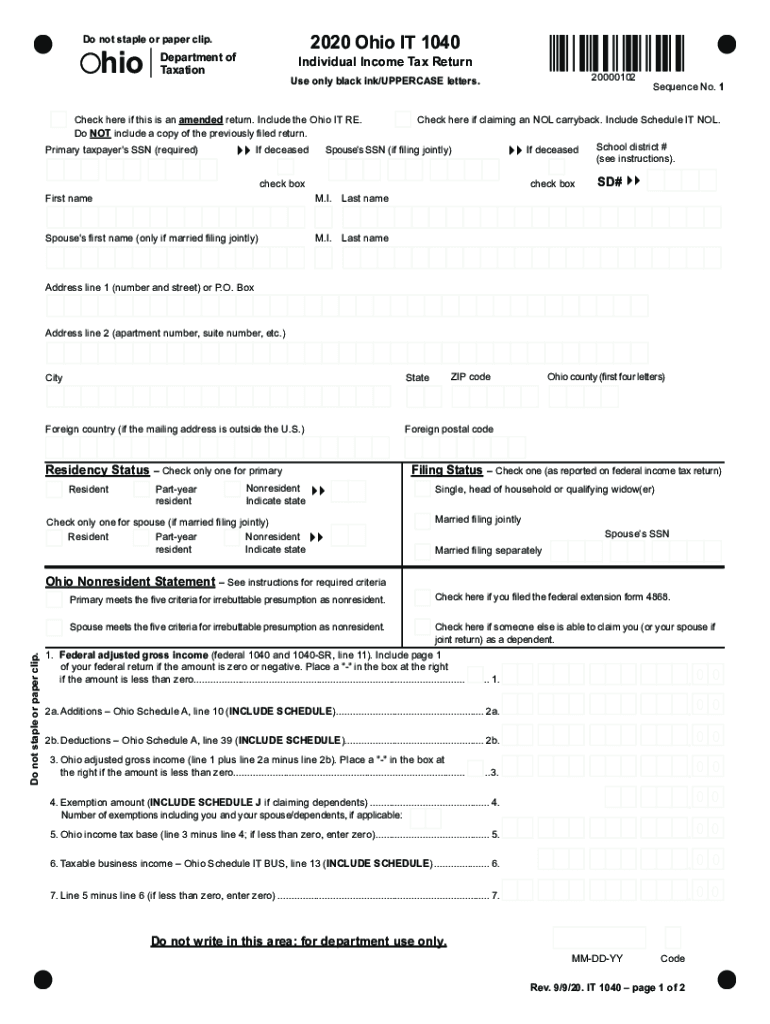

Ohio State Tax Withholding Form 2025 Twila Ingeberg, Effective january 1, 2025, senate bill (sb) 951 removes the taxable wage limit and maximum withholdings for each employee subject to state disability insurance (sdi). What is the deadline for filing california state taxes in 2025?

Nc4 Allowance Worksheet, Enter personal information (a) first name and middle. Form used to apply for a refund of the amount of tax withheld on the.

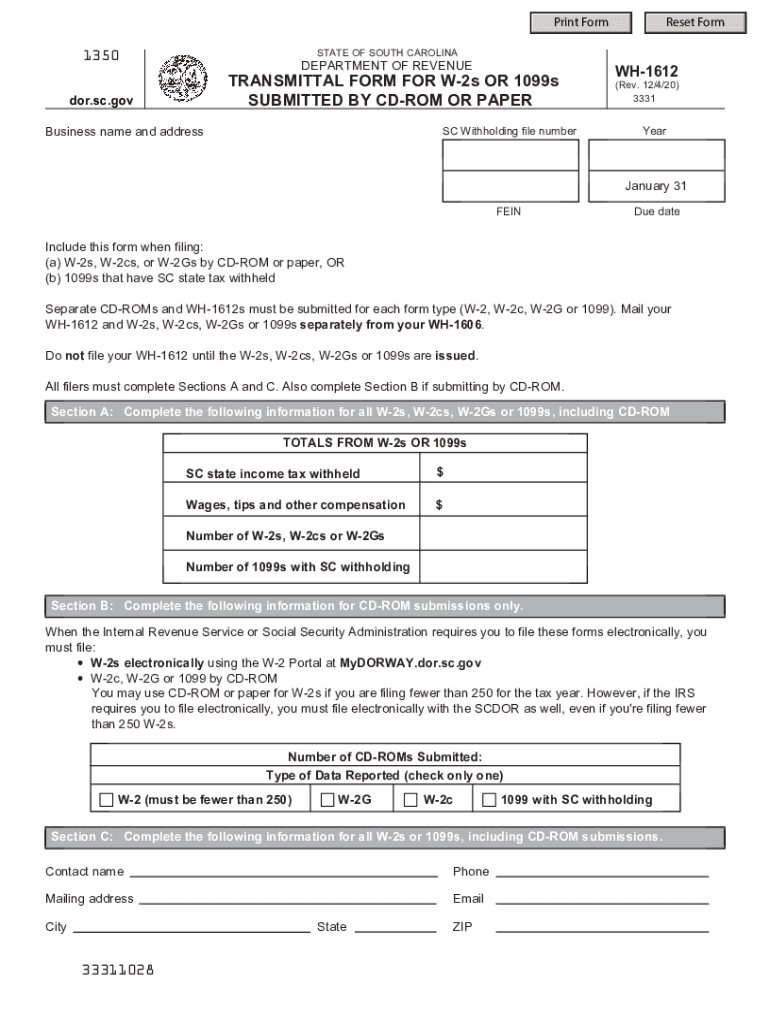

Filers Sc Withholding 20202024 Form Fill Out and Sign Printable PDF, Form used to apply for a refund of the amount of tax withheld on the. Calculate your tax using our calculator or look it up in a table of rates.

593 20232024 Form Fill Out and Sign Printable PDF Template, Home > state tax > california. In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state.

De 4p Form Complete with ease airSlate SignNow, The deadline to file a california state tax return is april 15, 2025 , which is also the deadline for federal. Paylocity updated standard deduction and allowance values for the effective date of january 1, 2025.

The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for.